Intermediaries

We work closely with Independent Financial Advisers (IFAs) and manage their clients’ underlying assets while they maintain the personal relationship with their client. If you don’t already have a financial adviser, solicitor or accountant, we would be delighted to introduce you to the appropriate individual, with you making the final decision whether to proceed. This is particularly relevant for pension advice and transfers, along with inheritance tax planning as well as a wider range of services.

Independent Financial Advisers

The client always belongs to you. We often introduce clients to financial advisers and in the same way we fully respect and acknowledge the relationship between you and your client.

Our services allow you to focus on the financial planning advice whilst we supply investment management services in accordance with your instructions and the client’s goals and objectives.

To make your life easier…

We provide a full Due Diligence Pack to cover the regulatory aspect.

Access to the client’s portfolio and additional information is available 24/7 through our Client Access portal which provides updated price information daily (valued at previous day’s close).

Raymond James has master agreements in place with multiple bond and pension providers ensuring speedy set up.

You will have a dedicated investment manager who is happy to attend your office for client meetings if more convenient as well as offering the facilities of our own office in the City of London.

Ad hoc reports can be prepared and sent out when required where we are not needed for meetings.

Solicitors and accountants

Professional services clients such as solicitors and accountants can access Raymond James, London Wall services both for themselves and for their private clients. Please enquire for more information.

Court of Protection

Working with intermediaries who assist in managing the financial affairs of someone who has received a compensation award for a personal injury. Our service has been designed to help Deputies and Professional Trustees deliver the best quality of care and support. We have considerable experience in the advice and management of funds on behalf of clients who are in receipt of Clinical Negligence Awards and where their affairs are managed through a Court of Protection Deputy.

Our Portfolio Range

For clients with over £400,000 to invest.

We work alongside you to create genuinely bespoke solutions that are tailored to each of your clients’ specific needs and aspirations and aligns with the financial plan you have created for the client.

At this investment level we can give your client access to direct equity investments, creating diversity and continuing to reduce overall costs. At Raymond James we have an extensive research capability including over 80 in-house equity analysts covering 1250 companies globally.

For clients with investments between £100,000 to £400,000.

A dynamic collective portfolio solution that is designed to fit around your clients’ attitude to risk and is dependent on whether they are looking for growth, income or would like more certainty in retirement.

For clients with less than £100,000 and starting from as low as £9,000.

A Discretionary model portfolio service for smaller portfolios (General Investment Account (GIA) & Individual Savings Accounts (ISA)). This is a range of diversified and actively managed portfolios, centrally managed in our Head Office, and advised by the Raymond James Asset Management Services Team.

Investment mandates

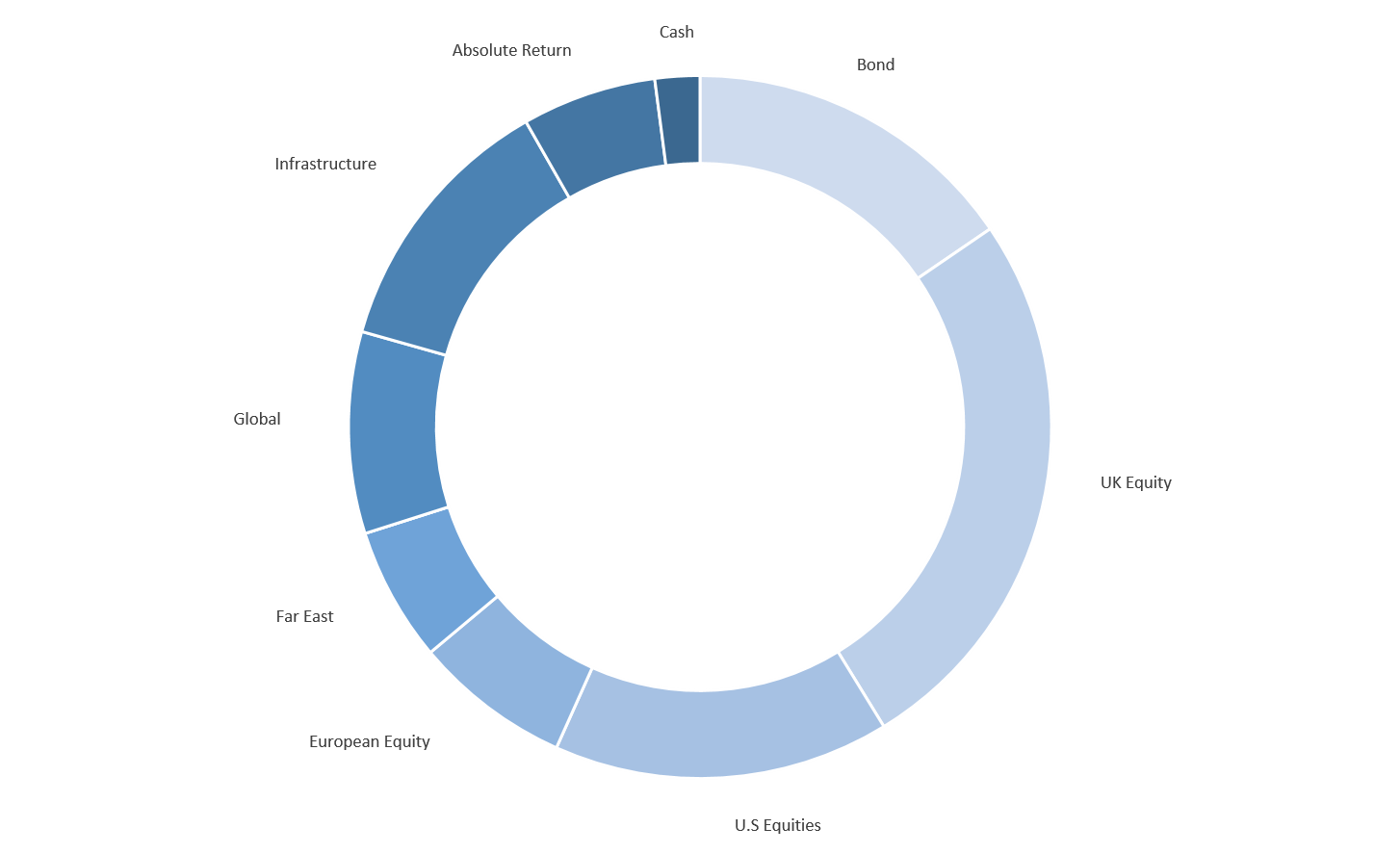

Our conservative mandate looks to provide moderate growth potential with a higher focus on capital preservation and income. This may be appropriate for clients who want to manage volatility and are somewhat sensitive to market fluctuations over a cycle.

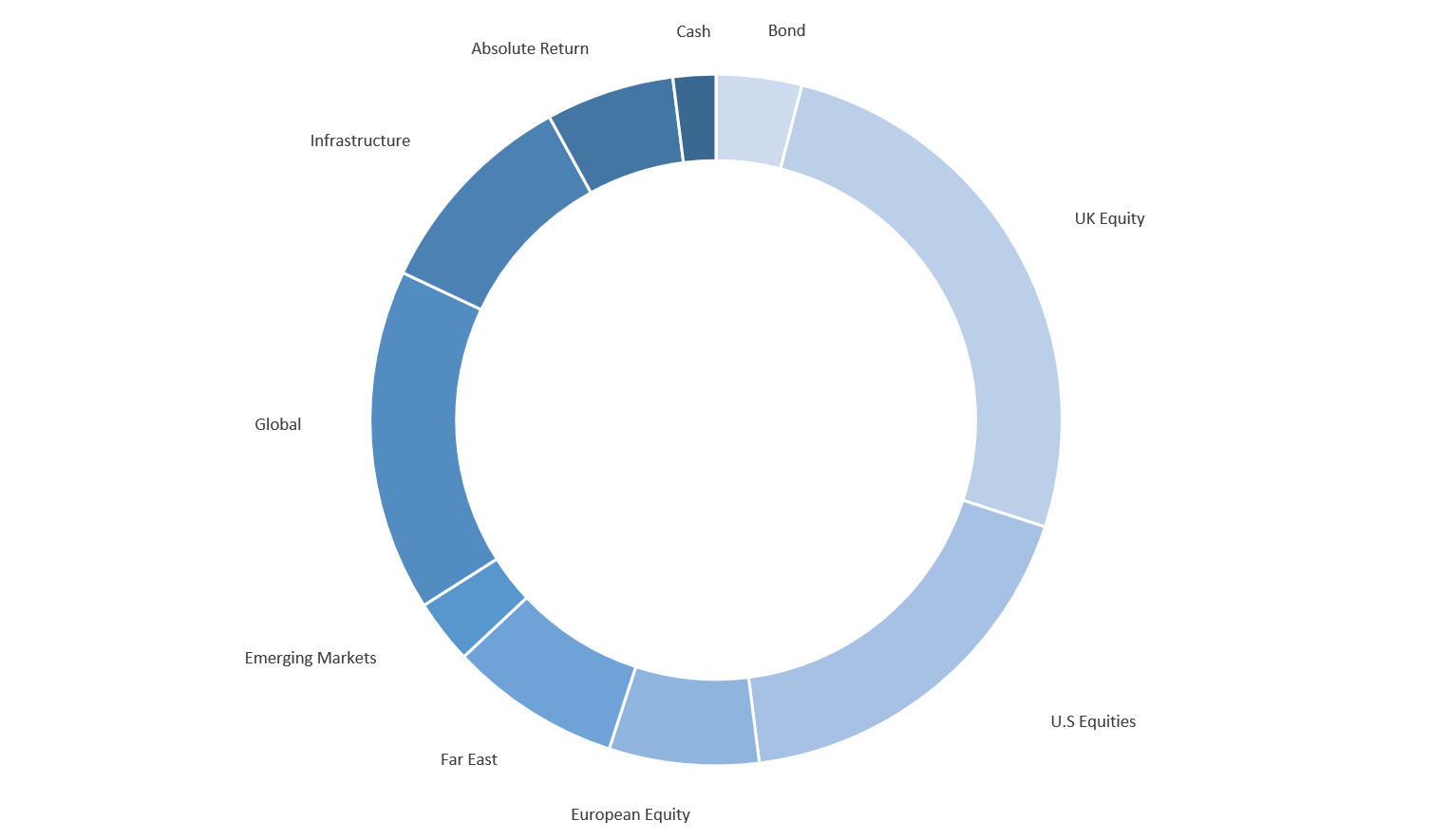

Our balanced mandate looks to provide long-term capital appreciation with growth potential as well as income. This may be appropriate for clients who can accept some level of volatility over a full market cycle.

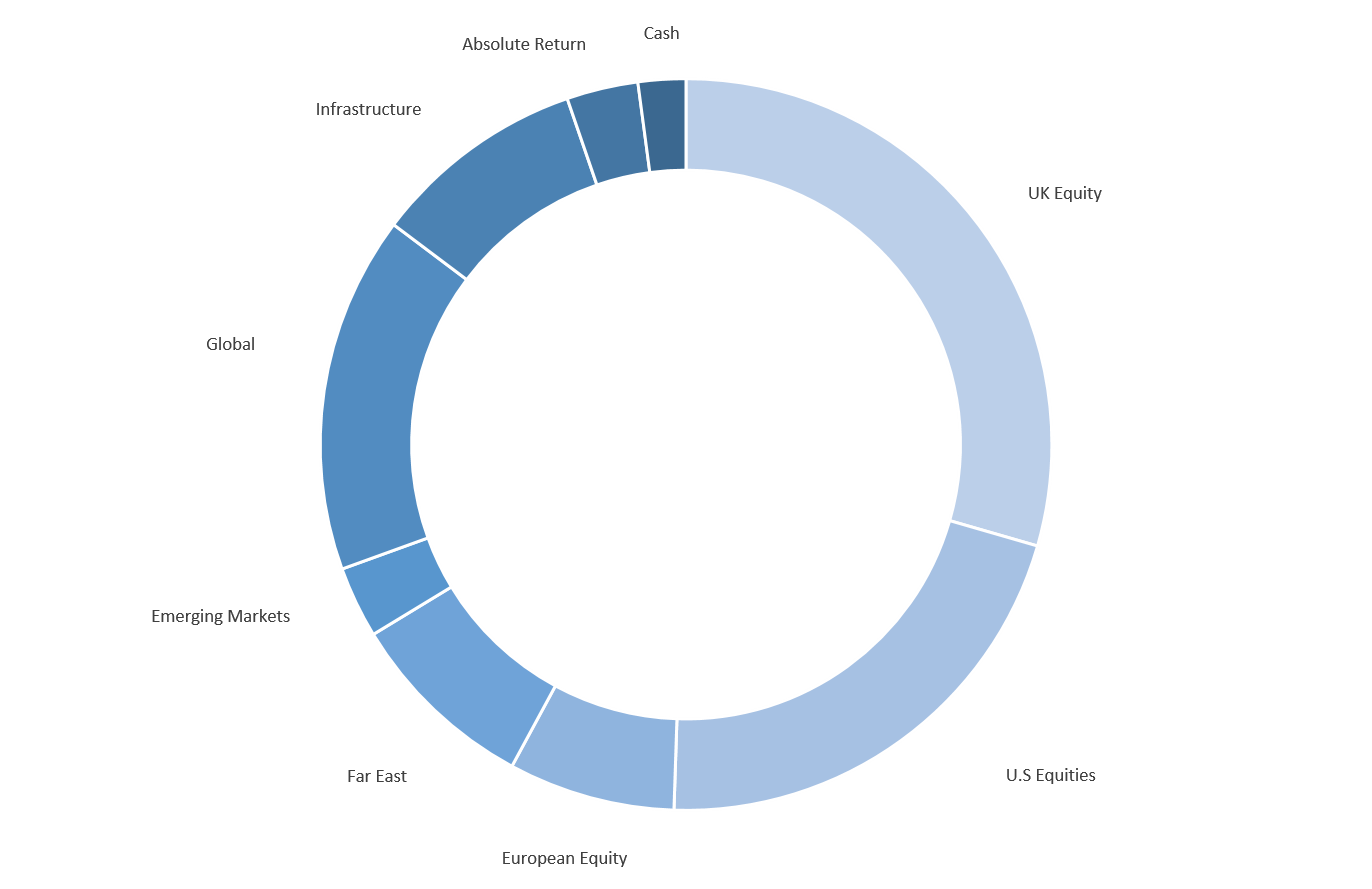

Our growth mandate looks to provide long-term capital appreciation with strong growth potential. This may be appropriate for clients who can accept a moderate level of volatility over a full market cycle.

The above is only a guide to the portfolios described and the constituents and their weightings are subject to change at any time.